Retirement Journey

START PLANNING YOUR

At the heart of Retirement Resources is a genuine passion for serving people. Founded on the belief that true financial security empowers individuals to live life fully, we are committed to helping our clients achieve freedom—whether through time, finances, or support—ensuring the most fulfilling and secure retirement possible.

THE RETIREMENT RESOURCES DIFFERENCE

When residents of Wyoming seek trusted advice on wealth management, retirement planning, long-term care, health costs, Social Security maximization, and more, they turn to Retirement Resources, a firm whose Wyoming roots trace back to 1976. With decades of experience and a commitment to personalized service, we are here to guide you toward a secure and confident financial future.

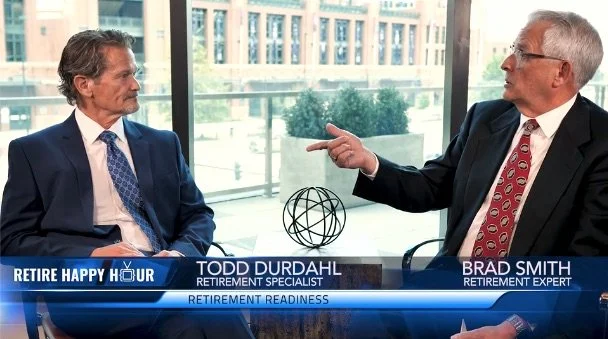

Retire Happy Hour

Watch Now!

The Retirement Resource Process

OUR PROCESS

The PLAN Success Cycle is our ongoing process for understanding your financial goals and developing a plan to pursue them effectively through a four-phase cycle: Prepare, Learn, Align, and Navigate.

Learn more >

The Wealth CheckPoints are our comprehensive and coordinated financial planning solutions designed to deliver definable value across five key areas: Investment Planning, Retirement Planning, Tax Planning, Legacy Planning, and Risk Management Planning.

Learn more >

The Quadrant Plan defines the purpose of your portfolio and customizes your investment allocation around four priorities: Yield, Protection, Balance, and Growth.

Learn more >

The Portfolio Pillars are five convictions that form the foundation of our investment management process: Smart Strategy, Rigorous Rebalancing, Disciplined Diversification, Intelligent Investments, and Meticulous Monitoring.

Learn more >

Do you have a coordinated Income Plan keeping you on course to your goals?

An intentional income plan can help ensure your assets sufficiently meet your desired and required expenses today and over your lifetime. Contact us for a complimentary, no-strings-attached Income Plan.

Is your portfolio prepared for the transitions in your financial life?

It is critical to periodically review your portfolio to ensure that it continues to reflect the changes in your financial picture and the investment industry. Contact us for a complimentary, no-strings-attached Portfolio Analysis.

Timely Market Insights

Access our monthly Market Review commentary which provides a simple, easy-to-understand assessment of the economy and financial markets.

OUR TEAM

Meet your team of professionals

GET IN TOUCH